Call option profit formula

Profit 8 x 100 x 3 contracts 2400 minus premium paid of 900 1500 1667 return 1500 900. The buyer of the call option has no upper limit on the potential profit and a.

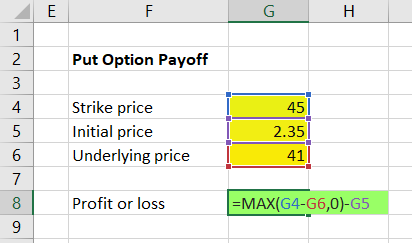

Put Option Payoff Diagram And Formula Macroption

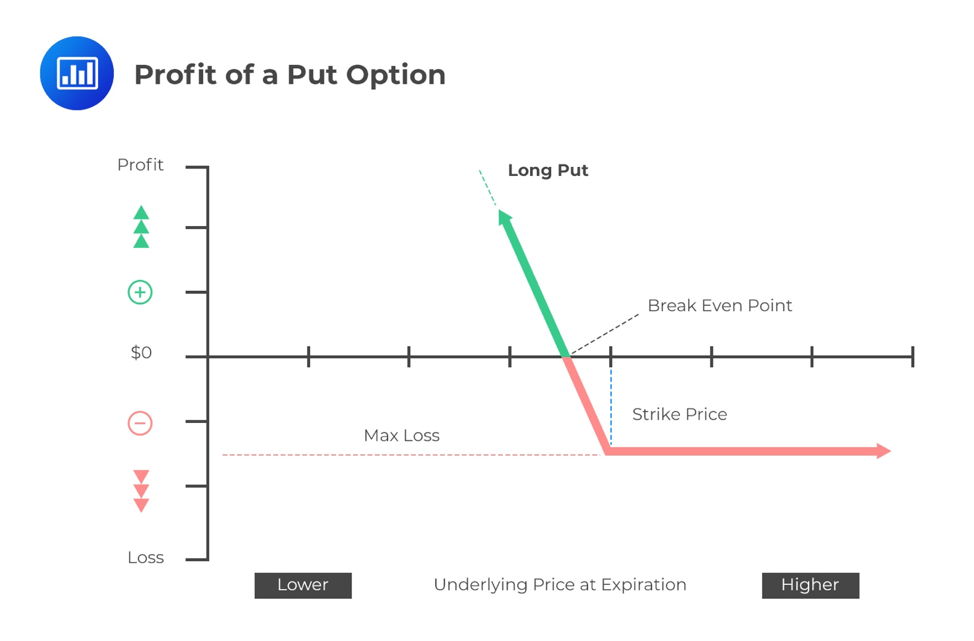

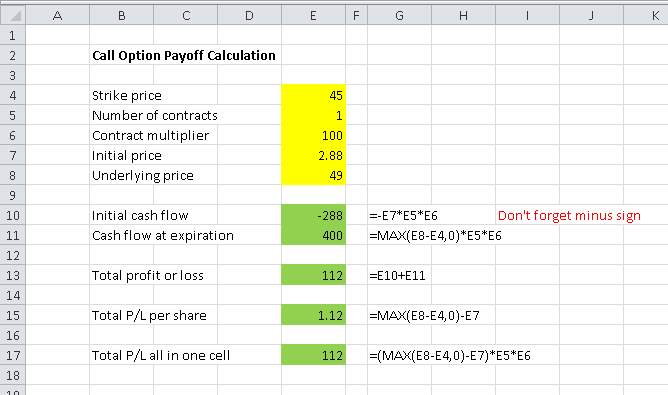

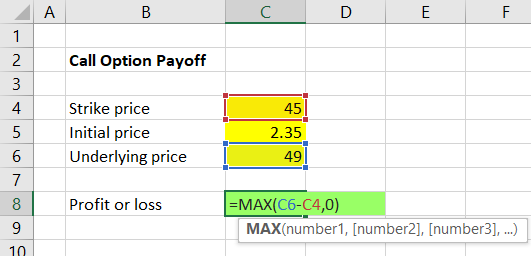

Profit Strike Price Underlying Price Initial Option Price x number of contracts Using the previous data points lets say that the underlying price at expiration is 50.

:max_bytes(150000):strip_icc()/dotdash_Final_Measure_Profit_Potential_With_Options_Risk_Graphs_Mar_2020-01-91faf67825434baba1a46837f4bf1ef3.jpg)

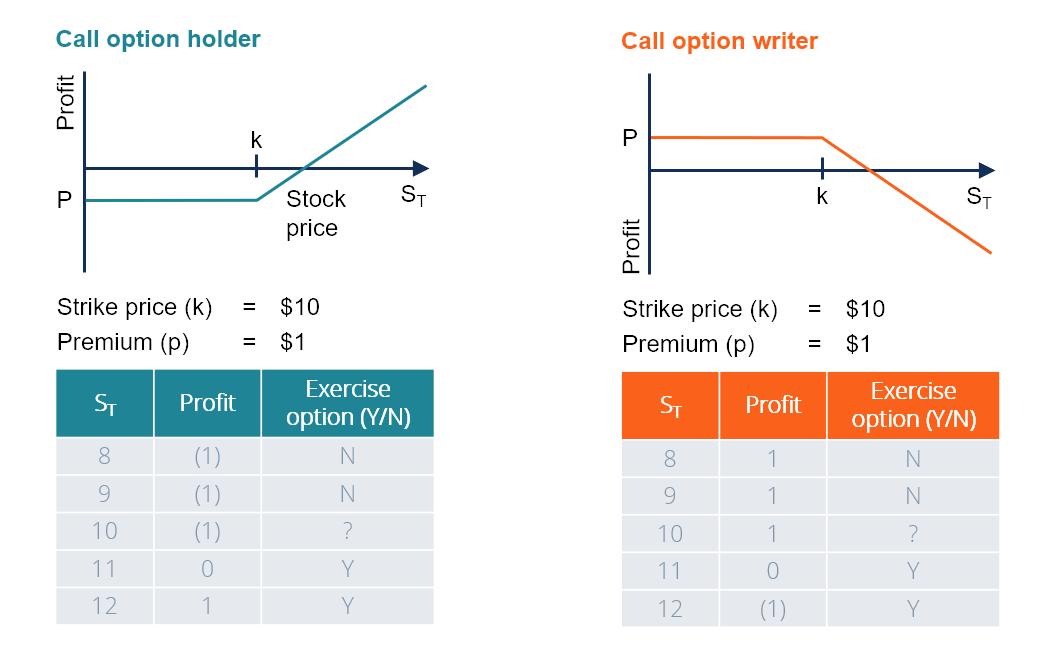

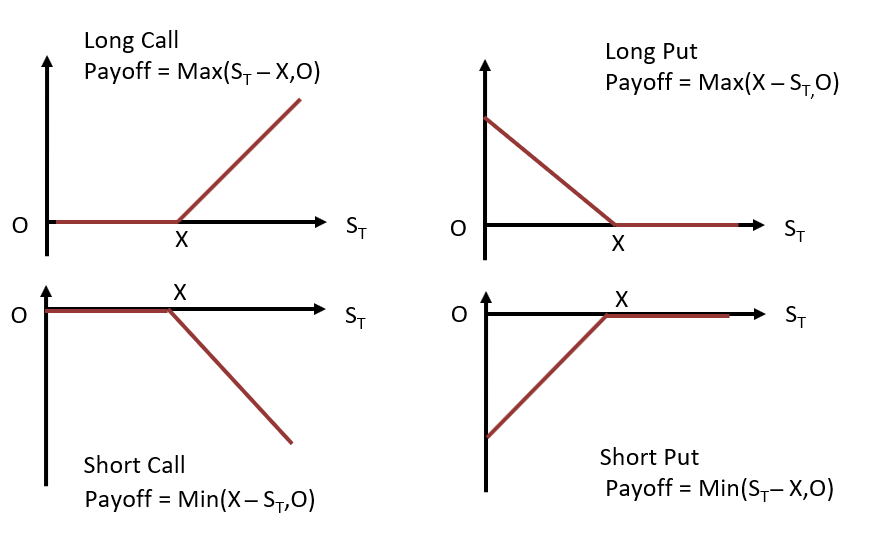

. The Profit at expiry is the value less the premium initially paid for the option. An call options Value at expiry is the amount the underlying stock price exceeds the strike price. Profit for a call seller max0ST Xc0 m a x 0 S T X c 0 where c0 c 0 the call premium.

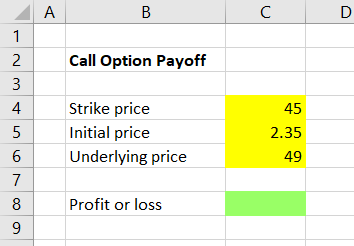

IFcondition result if condition is true result if condition is false In our case. Call Option Example 3. Using the same formula.

The options price when you bought it. To convert this figure into a percentage value reflective of total return divide the profit by the total purchase price of the asset and then multiply the resulting figure by 100. Since the option will not be exercised unless.

We can do this easily using Excel IF function which takes three parameters and looks like this. Breakeven BE strike price option premium 145 350 14850 assuming held to expiration The maximum gain for long calls is theoretically unlimited regardless of the option. Purchase of three 95 call option contracts.

Next we will find the net profit on the call option on HP stock. Net profit Total call option value option cost 11000 5000 x 2 1000. 3 Divide sum additional profit on exercise time value by net trade debit.

P Profit K Strike price S Stock price c Call price If the underlying assets price is lower than or equal to the strike price at the expiration date the holder does not.

Understanding Options Expiration Profit And Loss Cme Group

Call Option Understand How Buying Selling Call Options Works

Value At Expiration And Profit For Call And Put Options Analystprep Cfa Exam Study Notes

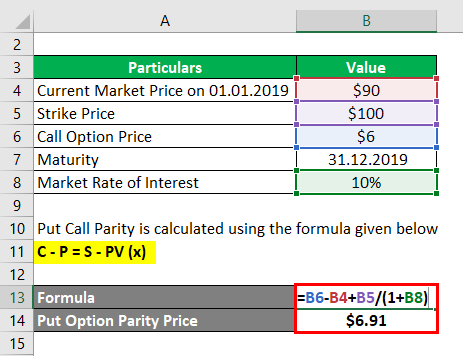

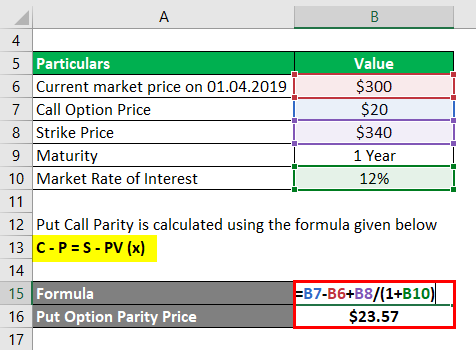

Put Call Parity Formula How To Calculate Put Call Parity

:max_bytes(150000):strip_icc()/dotdash_Final_Measure_Profit_Potential_With_Options_Risk_Graphs_Mar_2020-01-91faf67825434baba1a46837f4bf1ef3.jpg)

Measure Profit Potential With Options Risk Graphs

Call Option Payoff Diagram Formula And Logic Macroption

How To Calculate Payoffs To Option Positions Video Lesson Transcript Study Com

Put Call Parity Formula How To Calculate Put Call Parity

Options Payoffs And Profits Calculations For Cfa And Frm Exams Analystprep

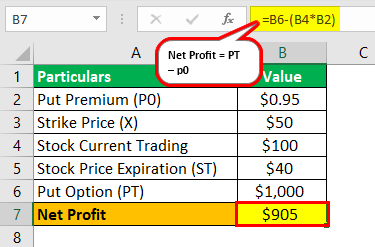

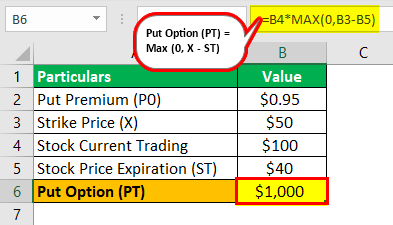

Put Option Meaning Explained Formula What Is It

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Put Option Meaning Explained Formula What Is It

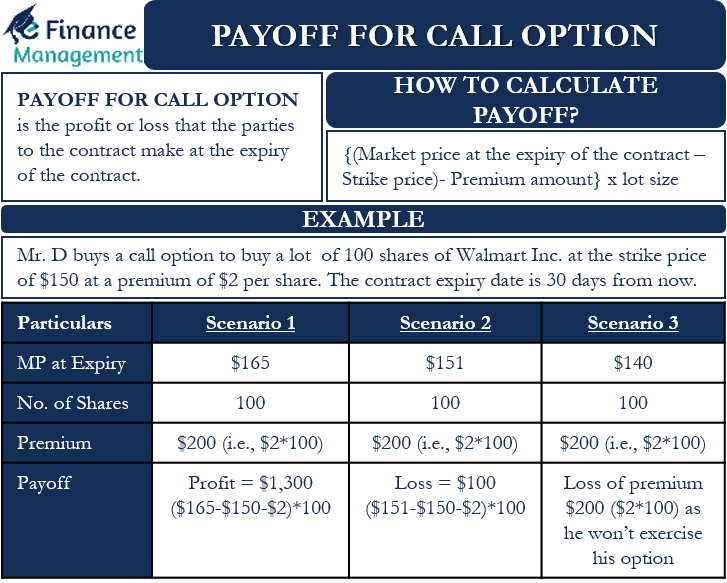

Payoff For Call Option Meaning Calculation And Examples

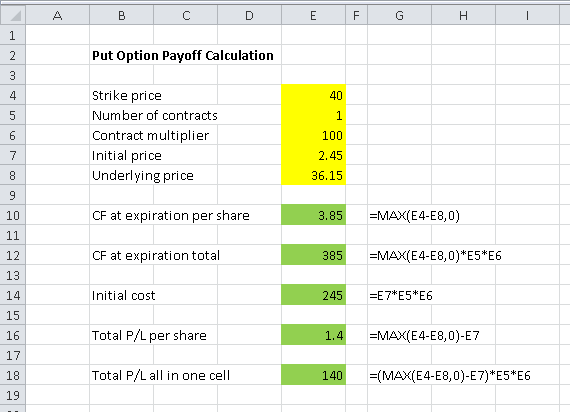

Calculating Call And Put Option Payoff In Excel Macroption

Calculating Call And Put Option Payoff In Excel Macroption

Calculating Call And Put Option Payoff In Excel Macroption

Put Call Parity Formula How To Calculate Put Call Parity